Answer:

Ans. Since the annual rate is not compunded (for example, compounded monthly) you will have to pay in interest $27.41, and the total payment is $1,061.41

Explanation:

Hi, since the balance is 1 month overdue, it means that you owe 2 months of interest to this obligation, but before we start finding the interest of your credit card, first let´s find the effective monthly equivalent rate for that 17% annual interest rate.

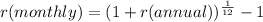

The formula is as follows.

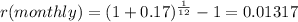

Therefore

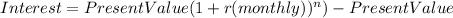

So your monthly interest rate is 1.317%. Now let´s find the amount of interests that you have to pay for 2 months. This is the formula.

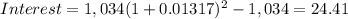

Where "n" is the period of time in months that you owe to the financial institution. The result of that is:

This way, interest are = $27.41 and the total amount that you will have to pay is:

Best of luck.