Answer:

D. less than $10,000.

Step-by-step explanation:

As for the provided information we have,

Bond face value = $10,000

Coupon rate = 6%

Maturity value = $10,000

Rate of interest = 7%

Number of period = 1

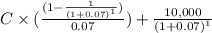

Bond value =

Where, C = $10,000

0.06 = $600

0.06 = $600

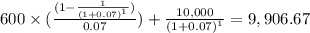

Now putting values we have,

Bond value =

Since the value is less than $10,000

Correct option is :

D. less than $10,000.