Answer:

option (A) 12%

Step-by-step explanation:

Data provided :

Purchasing cost of the machine = $ 22,712

Useful life of the machine = 5 years

Net annual cash inflow generated per year = $ 6,300

Now,

at for the value for internal rate of return,

the present value of inflow = Present value of the outflow for the 5 years

let the internal rate of return be r%

thus,

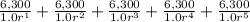

$ 22,712 =

on solving the above relation, we get

r ≈ 12%

Hence, option A is correct