Answer:

$37.14 price per share

Step-by-step explanation:

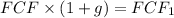

FCF x (1+g) = FCF1 = 150 x 1.04 = 156

We use the gordon model but instead of dividends we use the free cash flow for the firm.

Like dividend growth model, we need to use the next year value

150 x 1.04 = 156

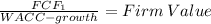

156/(0.11-0.04) = 2228.571429 (millions)

Then we divide the valuation by the outstanding shares:

2228.571429/60 = $37.14 price per share