Answer:

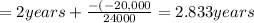

The company requires a payback of three years or less, therefore select Project X whose payback is 2.833 years.

Step-by-step explanation:

Payback is the number of years it will take for the company to recover the initial investment.

Project X

Year Cash-flow Balance

0 (68,000) (68,000)

1 24,000 (44,000)

2 24,000 (20,000)

3 24,000 4,000

4 - 4,000

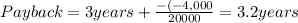

For Project X, at the end of year 2, the company still needs to recover $20,000. At the end of year 3, the project is reflecting a positive cumulative balance, implying that payback was reached some month after year 2.

Project Y

Year Cash-flow Balance

0 (60,000) (60,000)

1 4,000 (56,000)

2 26,000 (30,000)

3 26,000 (4,000)

4 20,000 16,000