Answer:

NPV -87,259.64

Step-by-step explanation:

P0 -100,000

Salvage Value 15,000

operating working capital realese 5,000

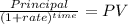

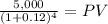

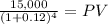

We will calculate the present value of the salvage value and the working capital realese

3,177.59

9,532.77

NPV = investment - cash flow discounted

NPV = -100,000 + 9,532.77 + 3,177.59 = -87,259.64