Answer:

WACC 11.25%

Step-by-step explanation:

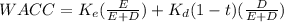

cost of equity:

equity:

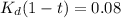

after tax cost of debt:

debt to equity:

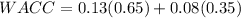

WACC = 0.11250 = 11.25%

Notice that we multiply the cost of capital by the percent of the capital structure which is equity.

And we multiply the cost of debt by the part of debt in the capital structure