Answer:

Job 301 $ 11,000

Job 302 $ 16,500

Job 303 $ 22,000

Step-by-step explanation:

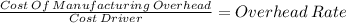

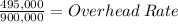

To calculate the overhead rate we divide the estimated overhead cost by the estimated cost driver:

0.55 overhead rate

Job 301 $20,000 labor cost x 0.55 overhead rate

11,000

Job 302 $30,000 labor cost x 0.55 overhead rate

16,500

Job 303 $40,000 labor cost x 0.55 overhead rate

22,000