Answer: The answer is as follows:

Step-by-step explanation:

Joyce's Gift signs a three-month note

period expired = 2 months

Note is signed on Nov 1 in the amount of $50k with annual interest 12%

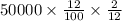

Interest =

= $1000

Therefore, the Journal entry for this adjustment is as follows:

Interest Expense A/C 1000

To Interest Payable A/C 1000

(adjusting entry to be made on Dec 31 for the interest expense accrued to that date)