Answer:

Monthly Rent = 92825.46

Step-by-step explanation:

Total investment 6,000,000

Income per year: X

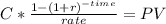

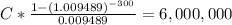

rate of return 0.009489 per month

time 25 years x 12 months = 300

We will solve for the monthly income of the project.

This should be the net income per month $60,492.12803

Now well do the monthly income statment to solve for rent:

Rent + Aprreciation of land - Property tax - maintenance = net income

Rent + 1,200,000 x 0.05/12 - 400,000/12 - 100 x 40 = 60492.13

Rent = 60492.13 - 5000 + 33333.33 + 4,000 = 92825.46