Answer:

Fixed Cost = $24,000 Variable cost = $5

Step-by-step explanation:

You have to use the High-Low method

From the table you got, you pick the higher and the lowest unit sold

and calculate the diference between them:

![\left[\begin{array}{ccc}&$Units&$Shipping Expense\\$High&44,400&246,000\\$Low&30,000&174,000\\$Diference&14,400&72,000\\\end{array}\right]](https://img.qammunity.org/2020/formulas/business/college/k1x2z78n04wammjgl17r06ysn3yma7zht8.png)

Now 14,400 Units generates a cost of 72,000 Dividing we get the variable component

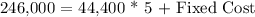

Then we calculate for the fixed cost:

Fixed Cost = 24,000