Answer:

$7.73

$131,450

$9,500

$9.44

$12.44

$4,590

$107,600

$-1,620

Explanation:

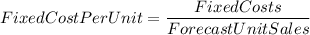

Let's take it one at a time. To find the fixed costs per unit, we use the formula.

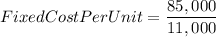

So our variables are.

Fixed Costs = $85,000

Forecast = 11,000 units

Now we compute.

Now for the Gross Sales, we simply take the selling price per unit and multiply it to the forecast unit sales.

GrossSales = Selling Price x Forecast Unit Sales

GrossSales = $11.95 x 11,000

GrossSales = $131,450

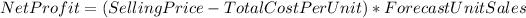

To compute for the possible net profit, we use the formula:

SellingPrice = $12.45

TotalCostPerUnit = $11.50

ForecastUnitSales = 10,000

NetProfit = (12.45 - 11.50) x 10,000

NetProfit = 0.95 x 10,000

NetProfit = $9,500

FixedCosts = $85,000

ForecastUnitSales = 9,000

FixedCostPerUnit = $9.44

Now that we have our Fixed Cost Per Unit we simply add our Variable Cost to get the Total Cost Per Unit.

TotalCostPerUnit = FixedCostPerUnit + VariableCost

TotalCostPerUnit = $9.44 + $3.00

TotalCostPerUnit = $12.44

Now for the Net Profit.

SellingPrice = $12.95

TotalCostPerUnit = $12.44

ForecastUnitSales = 9,000

NetProfit = (12.95 - 12.44) x 9,000

NetProfit = 0.51 x 9,000

NetProfit = $4,590

Now we're looking for Gross Sales again, so we use:

GrossSales = Selling Price x Forecast Unit Sales

GrossSales = $13.45 x 8,000

GrossSales = $107,600

SellingPrice = $13.45

TotalCostPerUnit = $13.63

ForecastUnitSales = 8,000

NetProfit = (13.45 - 13.63) x 8,000

NetProfit = -0.18 x 9,000

NetProfit = $-1,620

So we can see that we have a profit loss at 8,000 units and a selling price of $13.45