Answer:

44. 7 yr

Explanation:

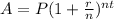

The compound interest equation is

You don't give the frequency of compounding, so I will assume that it is once per year.

Data:

P = $40

r = 0.5 % = 0.005

n =1

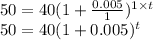

Calculations:

(a) Calculate A

A = P + I = 40 + 10 = $50

(b) Calculate t

Divide each side by 40

Take the logarithm of each side

log1.25 = tlog1.005

0.09691 = 0.002 166t

Divide each side by 0.002 166

t = 44.7 yr

The value of the stock will be $50 in 44.7 yr.