Answer:

The total monthly mortgage payment for the house is $975.63

Explanation:

The principle amount is $175000

80% of 175000 is =

= $140000

= $140000

20% of 175000 is =

= $35000

= $35000

Emi formula is :

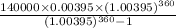

For 1st part:

p = 140000

r = 4.75/12/100=0.00395

n =

Putting values in formula we get

= $729.508

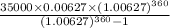

For 2nd part:

p = 35000

r = 7.525/12/100=0.00627

n =

Putting values in formula we get

= $245.301

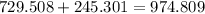

Adding both the monthly payments:

dollars

dollars

This is closest to option A.

So, option A is the answer.

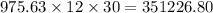

And for 30 years the mortgage payment will be =

dollars

dollars