Answer: After 12 years ( approx )

Explanation:

Let after t years the amount in met bank will exceed to the amount in Yankee bank,

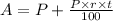

For Yankee bank,

The principal amount, P = $ 10,000

Simple annual interest rate, r = 5 %

Hence, the amount in this bank after x years,

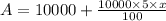

Now, For Met bank,

The principal amount, P = $ 10,000

Compound annual interest rate, r = 4 %

Hence, the amount in this bank after x years,

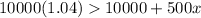

⇒For exceeding,

By the below graph, the above condition occurs after intersection of

and

and

at (11.919, 15959.341)

at (11.919, 15959.341)

Hence, after x = 11.919 ≈ 12 years the amount in Met bank will be greater than that of Yankee bank.

⇒ For 12 years Met Bank will be the better choice.