Answer:

mutual fund

Explanation:

Step one:

given data

let say the investment plan will span for 5 years

so for mutual fund

P= $1000

r= 7.5%= 0.075

t= 5

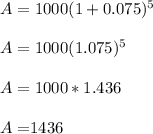

compound interest

A= P(1+r)^t

substituting

$1436

so for bond

P= $1000

r= 7.5%= 0.075

t= 5

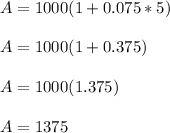

simple interest

A= P(1+rt)

substituting

A=$1375

$1375

I would go for mutual fund compounded interest because it offers extra

$61 (1436-1375) for the same investment capital