Answer:

a) $26

b) 24.07%

c) $94.3

Explanation:

Given that:

Before tax:

Normal price of dress = $62

Discounted price of dress = $48

Normal price of a pair of shoes = $46

Discounted price of a pair of shoes = $34

a) Before the sales tax, total savings = ($64 - $48) + ($46 - $34) = $26

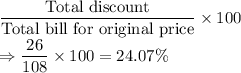

b) Total percentage discount on total sales.

Total bill for original price = $62 + $46 = $108

Percentage discount can be found by the formula:

c) Total amount paid if the sales tax is 15%.

Amount paid with tax = Amount after discount + 15% of amount after discount

Amount after discount = $48 + $34 = $82

15% of $82 = $18.29

Amount paid with sales tax = $82 + $12.3 = $94.3